Quantbase

Strategies

FAQ

Become a partner

Sign in

Get started

Invest like

Statis Fund

Statis Fund

Automated investing in Statis Fund's quantitative strategies and ideas, fully managed on your behalf by Quantbase.

RoundlyX Global Arms Race and Conflict Fund

Volatis Strategy

3.80/5

Risk score

Statis Fund's

investing strategies

investing strategies

RoundlyX Global Arms Race and Conflict Fund

Volatis Strategy

3.80/5

Risk score

View disclosures and methodology

RoundlyX Global Arms Race and Conflict Fund

Innotis Strategy - Quantum Exposure Fund

3.69/5

Risk score

View disclosures and methodology

RoundlyX Global Arms Race and Conflict Fund

Innotis Strategy - AI Exposure Fund

3.14/5

Risk score

View disclosures and methodology

How it works

Statis Fund has partnered up with Quantbase, a platform for hosting and managing automated investing strategies.

Create a Quantbase account to automate your investments.

Subscribe to Statis Fund's strategies

Monitor and manage your investments

Our founders

We're a team of engineers and investors who have built and invested in quantitative trading strategies for almost a decade. We're passionate about making quantitative investing accessible to everyone and put our money where our mouth is.

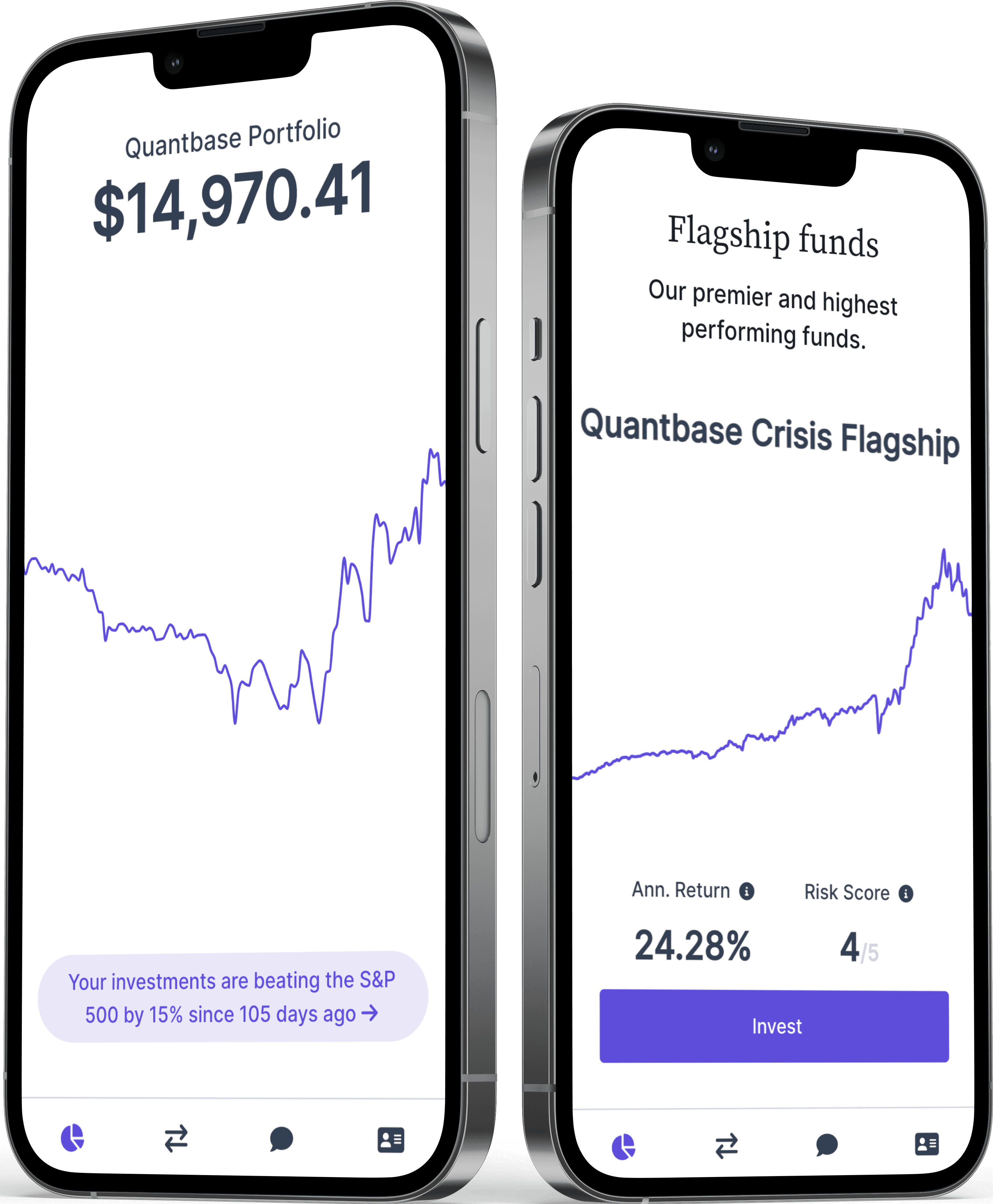

About Quantbase

Quantbase is an investment platform that builds quantitative and rules-based strategies on behalf of financial professionals, enterprises, creators, and other thought leaders. We then automate the execution of those strategies for anyone who wants to participate.

Quantbase is an SEC-registered investment adviser. All investments made through our platform are SIPC-insured and secured with bank-grade encryption. There are no lock-ups and you can start with just $50.

Quantbase's world-class engineering and design teams strive to deliver a first-class mobile app and desktop website made specifically for the modern investor.

How does Quantbase work?

You move money from your bank or investment account onto Quantbase, then into one of our automated strategies. Once invested, Quantbase fully manages the strategies you're invested in, ensuring rebalances into the proper asset allocations at the proper times, as informed by the strategy. When the professionals you trust make money, you also make money.

How much does Quantbase cost?

Our fee structure is a simple $10/mo for accounts under $12,000 or 1% annually of the managed assets for accounts greater than $12,000*. For example, $15,000 invested would only be $12.50/mo. Our partners may charge a separate subscription fee for access to their strategies.

For Statis clients, we offer a competitive management fee of 0-2% depending on the client, and in some cases (qualified investors only), performance fees may apply.

Where is my capital held?

Quantbase partners with Alpaca Securities LLC as our broker and custodian. All cash balances are FDIC-insured, and all investments are SIPC-insured through Alpaca. We manage your assets, while Alpaca holds the assets and executes the trades. Learn more about Alpaca here: https://alpaca.markets/broker#regulatory

How do you handle taxes?

We provide documents annually as they become available through your dashboard. As a quantitative hedge fund, most assets are traded frequently and taxed as short term capital gains, but our returns are high enough to compensate for the extra taxes.

Learn more

Ready to start investing?

Create an account in 5 minutes.